All Categories

Featured

Table of Contents

Variable annuities have the potential for greater profits, but there's even more danger that you'll lose money. Be cautious concerning placing all your possessions into an annuity.

Take some time to make a decision (annuity guarantees by state). Annuities sold in Texas has to have a 20-day free-look duration. Substitute annuities have a 30-day free-look period. Throughout the free-look duration, you might cancel the agreement and get a complete refund. A financial adviser can aid you assess the annuity and compare it to various other financial investments.

The quantity of any kind of abandonment charges. Whether you'll lose any type of bonus interest or attributes if you quit your annuity. The assured rate of interest prices of both your annuity and the one you're thinking about replacing it with. Just how much money you'll require to begin the brand-new annuity. The loads or commissions for the brand-new annuity.

Make sure any type of representative or company you're thinking about purchasing from is accredited and monetarily steady. new york life insurance annuities. To verify the Texas permit condition of a representative or firm, call our Aid Line at 800-252-3439. You can additionally use the Company Lookup function to discover a firm's financial score from an independent ranking organization

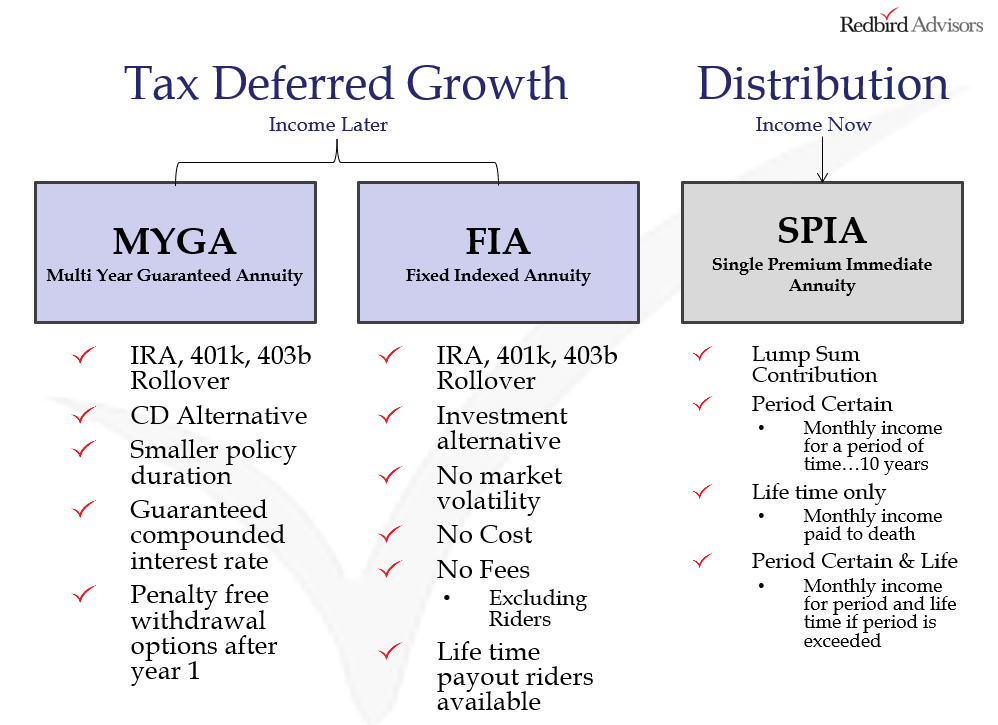

There are 3 types of annuities: repaired, variable and indexed. With a dealt with annuity, the insurance policy company assures both the rate of return (the passion price) and the payout to the financier.

Immediate Annuity Plans

With a deferred fixed annuity, the insurer consents to pay you no less than a specified rate of interest as your account is growing (cuna annuities). With an immediate set annuityor when you "annuitize" your delayed annuityyou get a predetermined set quantity of money, usually on a month-to-month basis (similar to a pension)

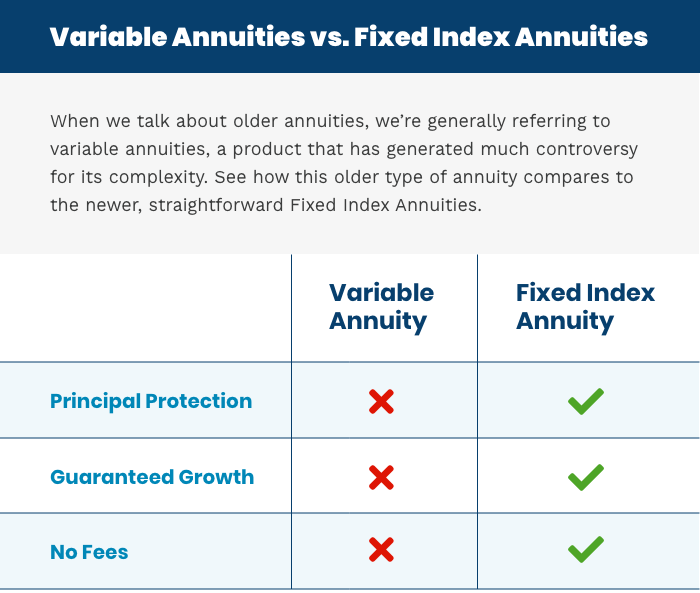

And, unlike a dealt with annuity, variable annuities do not give any type of assurance that you'll make a return on your financial investment. Instead, there's a risk that you can really shed cash.

Due to the complexity of variable annuities, they're a leading resource of investor complaints to FINRA. Prior to purchasing a variable annuity, carefully read the annuity's syllabus, and ask the individual marketing the annuity to clarify all of the product's attributes, motorcyclists, costs and restrictions. Indexed annuities commonly provide a minimal guaranteed passion rate integrated with an interest rate connected to a market index.

Understanding the functions of an indexed annuity can be confusing (what are fixed income annuities). There are several indexing approaches companies use to compute gains and, due to the fact that of the selection and intricacy of the methods used to credit scores interest, it's tough to contrast one indexed annuity to another. Indexed annuities are typically classified as one of the complying with two types: EIAs use an assured minimum rates of interest (typically a minimum of 87.5 percent of the premium paid at 1 to 3 percent rate of interest), in addition to an added rates of interest linked to the performance of several market index

5. The S&P 500 Index includes 500 huge cap stocks from leading firms in leading markets of the U.S. economy, recording around 80% insurance coverage of U.S. equities. The S&P 500 Index does not include returns proclaimed by any of the companies in this Index.

The LSE Team makes no claim, forecast, guarantee or depiction either regarding the outcomes to be gotten from IndexFlex or the suitability of the Index for the objective to which it is being put by New york city Life. Variable annuities are long-lasting economic items utilized for retirement savings. There are fees, costs, restrictions and dangers linked with this plan.

Withdrawals may be subject to regular earnings tax obligations and if made prior to age 59 might be subject to a 10% IRS charge tax obligation. This product is general in nature and is being given for informational objectives just.

The syllabus contain this and various other details concerning the item and underlying investment options. In most territories, the policy kind numbers are as adheres to (state variations may use): New York Life IndexFlex Variable AnnuityFP Collection (ICC20V-P02 or it might be NC20V-P02).

What Is An Annuity Contract

An income annuity starts dispersing settlements at a future day of your choice. Repaired deferred annuities, also known as repaired annuities, supply stable, surefire growth.

The value of a variable annuity is based upon the performance of a hidden portfolio of market financial investments. deferred lifetime annuity. Variable annuities have the advantage of giving even more choices in the method your cash is invested. This market exposure may be needed if you're seeking the chance to expand your retired life savings

This material is for details usage only. It must not be relied upon as the basis to acquire a variable, repaired, or prompt annuity or to carry out a retirement strategy. The information given here is not created or planned as investment, tax obligation, or legal suggestions and may not be depended on for purposes of avoiding any kind of government tax obligation penalties.

Tax obligation outcomes and the suitability of any type of item for any kind of specific taxpayer may vary, depending on the particular set of truths and circumstances. Entities or individuals dispersing this information are not authorized to offer tax or legal suggestions. People are motivated to look for details guidance from their individual tax or legal advise.

Variable annuities and their hidden variable financial investment options are offered by syllabus just. Investors need to think about the financial investment goals, risks, fees, and expenses carefully before investing. annuity company.

Variable Annuity Guarantee

Please read it before you spend or send out cash. Dealt with and variable annuities are issued by The Guardian Insurance & Annuity Company, Inc. (GIAC). All assurances are backed solely by the stamina and claims-paying capability of GIAC. Variable annuities are issued by GIAC, a Delaware company, and dispersed by Park Method Stocks LLC ().

5 Watch out for dealt with annuities with a minimal surefire rate of interest price of 0%. Enjoy out for advertisements that reveal high passion rates.

Some annuities offer a greater guaranteed interest for the first year just. Make certain to ask what the minimal rate is and exactly how long the high passion price lasts.

Stock Annuity

The major factor to purchase an instant annuity is to obtain a routine earnings right away in your retirement. Deferred Annuity: You begin getting revenue lots of years later, when you retire.

This product is for informative or instructional objectives just and is not fiduciary financial investment advice, or a securities, investment technique, or insurance coverage product recommendation. This material does rule out an individual's own goals or circumstances which should be the basis of any kind of financial investment choice. Financial investment products might be subject to market and various other danger elements.

Table of Contents

Latest Posts

Analyzing Strategic Retirement Planning Key Insights on What Is Variable Annuity Vs Fixed Annuity Defining the Right Financial Strategy Advantages and Disadvantages of Different Retirement Plans Why C

Highlighting the Key Features of Long-Term Investments Everything You Need to Know About Financial Strategies Breaking Down the Basics of Investment Plans Advantages and Disadvantages of Different Ret

Analyzing Strategic Retirement Planning A Comprehensive Guide to Pros And Cons Of Fixed Annuity And Variable Annuity Breaking Down the Basics of Retirement Income Fixed Vs Variable Annuity Features of

More

Latest Posts